LME aluminium price hiked for the third consecutive day to $1829.5/t amid rise in opening stock, SHFE slipped by $11/t

2020-10-15

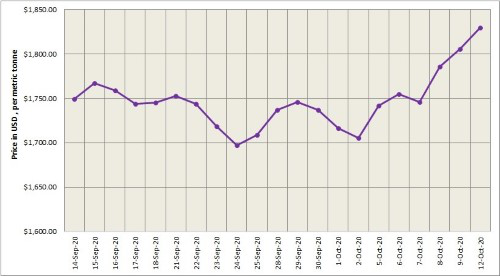

Three-month LME aluminium rose 0.49 per cent to end at US$ 1,856 per tonne on Monday, October 12, and is likely to move between US$ 1,830-1,870 per tonne today.

Both LME aluminium cash (bid) price and LME official settlement price increased further for the third consecutive day from US$ 1805.50 per tonne to US$ 1829.50 per tonne, as of October 12. 3-months bid price and 3-months offer price stood at US$ 1847 per tonne, up by US$ 27 per tonne from US$ 1820 per tonne. Dec 21 bid price and Dec 21 offer price hovered at US$ 1903 per tonne.

The LME aluminium opening stock increased from 1416325 tonnes to 1422475 tonnes. Live Warrants stood at 1126175 tonnes, while Cancelled Warrants at 296300 tonnes.

LME aluminium 3-months Asian Reference Price came in at US$ 1849.44 per tonne, as of October 12.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE slipped by US$ 11 per tonne from US$ 2205 per tonne to US$ 2194 per tonne on Tuesday, October 13, 2020.

The most-liquid SHFE 2011 aluminium contract closed up 1.35 per cent at RMB 14,595 per tonne. Open interest rose from 8,921 lots to 116,000 lots. The increase of aluminium ingots stocks was less than expected during the holiday. As delivery was approaching, the spot premium lifted the nearby future prices. The changes of economic data and policies of various countries and the continuous inflow of funds will come under scrutiny.

The most-liquid SHFE 2011 aluminium contract strengthened 0.97 per cent to close at RMB 14,630 per tonne in overnight trading, and is expected to trade between RMB 14,300-14,700 per tonne today.

COMPANY NEWS

COMPANY NEWS

INDUSTRY NEWS

INDUSTRY NEWS

LIST OF CLIENTS

LIST OF CLIENTS

- RELATED NEWS

- China’s A00 aluminium ingot price closes the week at RMB18,860/t with a drop; Average alumina spot price inches down by RMB1/t

- China July aluminium output hits record high after power restrictions loosened

- Shanghai Aluminum remains volatile and stocks on demand

- Statistics Bureau: October electrolytic aluminum output 3.132 million tons, go down 1.8%

- LME aluminium price opened lower after two-day holiday; SHFE aluminium fell 2.48%

- A00 aluminium ingot price in China opens the week higher at RMB15,160/t; Aluminium fluoride price soars by RMB350/t

- Aluminium ingot price climbs by RMB 110/t; Aluminium alloy (ADC12) price stands at RMB 15300/t

- LME aluminium price hiked for the third consecutive day to $1829.5/t amid rise in opening stock, SHFE slipped by $11/t

Online Order

Online Order

Whatsapp:+8617669729753

Whatsapp:+8617669729753

Email:alusales@sino-steel.net

Email:alusales@sino-steel.net

Go top

Go top