ALUMINIUM PRICES TO REMAIN UNDER PRESSURE ON GROWING INVENTORY AND NO COST SUPPORT

2019-01-18

According to the latest Weekly macro report from Shanghai Metals Market, aluminium prices in China are likely to trade under pressure in the near term as recent supply cuts in seven major smelters slowed down. Last week, social inventories of aluminium across eight consumption areas in China grew for the first time in seven weeks, reflecting slow downstream demand. Inventories of primary aluminium, including SHFE warrants, stood at 1.3 million tonnes as of Wednesday January 2, further up 16,000 tonnes from Thursday December 27.

The stocks of 6063 aluminium billet across five major consumption areas expanded 1.29% to 11,000 tonnes, SMM data showed.

Support to aluminium prices in China started reducing on the back of declining costs of major raw materials for primary aluminium production. Total production costs for primary aluminium producers shrank to RMB 1,056.25 per tonne as of Friday December 28, with losses narrowing to RMB 14,496.25 per tonne.

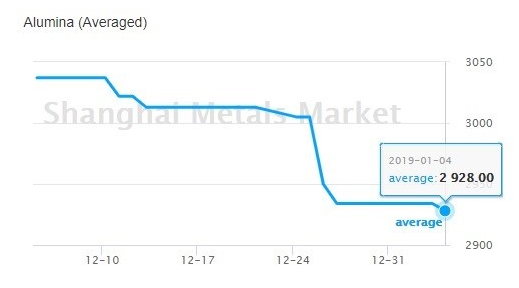

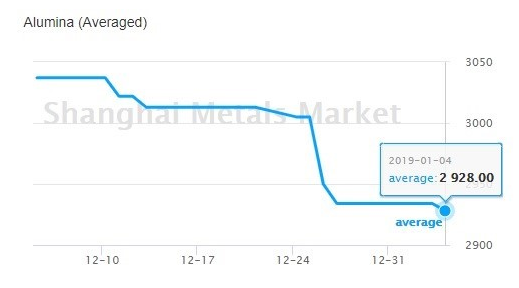

For the week ended January 4, domestic alumina prices dropped further to RMB 2,928 per tonne and fob Australia prices remained unchanged at US$405 per tonne, SMM data showed. Losses in alumina prices are likely to slow down in the short term as cash pressures at alumina refiners ease at the start of the year and as aluminium producers restock. Alumina prices are expected to remain under pressure as demand from smelters continued to remain sluggish on slow reopening of smelters and an oversupplied aluminium market. New alumina capacity in China is estimated to stand at 7.6 million tonnes in 2019, up 28.17% from 2018.

COMPANY NEWS

COMPANY NEWS

INDUSTRY NEWS

INDUSTRY NEWS

LIST OF CLIENTS

LIST OF CLIENTS

- RELATED NEWS

- Dear customer: The Sino Credit Mall revision has been launched!

- Notice on Phishing Mail Fraud

- How to Become the Focus of Adversity in this Epidemic

- Different mountains and rivers, the same wind and moon, we need to work together at hard times for the global to fight the epidemic

- Shandong sino steel co.,ltd

- Announcement

- 2019 Annual Meeting Of China Iron And Steel Industry Network Held Ceremoniously

- The 126th Canton Fair Ends with Success

Online Order

Online Order

Whatsapp:+8617669729753

Whatsapp:+8617669729753

Email:alusales@sino-steel.net

Email:alusales@sino-steel.net

Go top

Go top